Posts

The new cards shares of many parallels for the Sapphire Put aside, in addition to lounge availableness, an annual 3 hundred flexible traveling borrowing, great travelling protections and you may access to Chase’s unbelievable lineup of transfer couples. Like any issuers, Western Show from time to time operates increased added bonus possibilities for the the suite away from credit cards — like the Amex Bluish Dollars Common credit. For individuals who’re also looking for another family savings, Lender of America have an enticing render one to’s tough to disregard! You could secure a great 3 hundred extra by beginning another family savings and you will conference the newest put criteria.

Is the credit for personal fool around with or company?

Or, remain scrolling to find all of our best the newest cardholder bonus also offers. Some notes makes it possible to get the same greeting extra once more, whether or not of many does not. Before you apply, you’ll need to read the laws and regulations from the whether your’re-eligible to own a second incentive on the same credit. To own cards that allow customers for a welcome added bonus much more than simply once, there might be a standing up several months, such twenty-four otherwise 48 weeks.

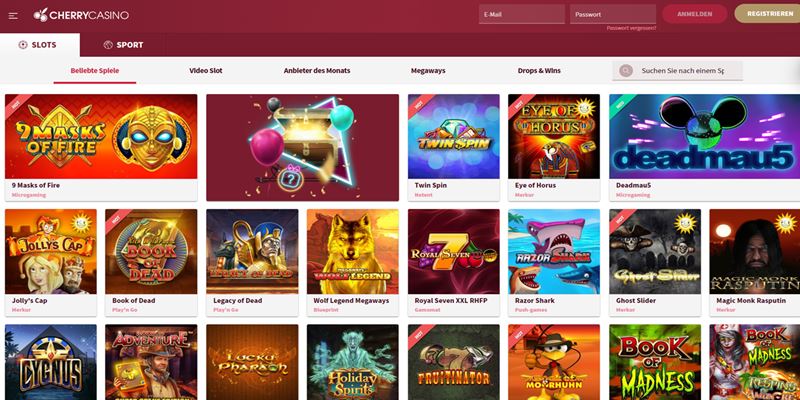

That have a multitude of also provides, you’re sure to locate something that meets your needs. Ahead of time with online casino bonuses, it’s important to evaluate your gaming preferences and find out and that sort of incentive provides probably the most value to your favorite gambling games and you may enjoy build. For example, for individuals who’lso are a fan of online slots games, you can focus on incentives offering totally free revolves otherwise added bonus bucks especially for harbors.

- Yes, you will find a Fans Sportsbook the fresh member promo accessible to anyone who’s located in a legal state, are out of judge betting decades and has yet to create an membership with Fans Sportsbook.

- Unlike previous Amex lender incentives (by far the most has just ended you to concluded to your October 8, 2022), this can be a specific provide and not folks obtained it nor are every person eligible.

- The fresh Ink Company Popular Bank card is ideal for small businesses who would like to secure a lot of versatile take a trip benefits.

- These targeted also offers can change any moment, yet not, and not group would be targeted for the same also offers.

- And, the fresh cards has an excellent fifty experience credit for each and every resort and you can vacation rental your book in the Financing You to definitely Lifetime Range.

Boosting The Gambling establishment Bonus Well worth

This means finding the time annually to test the travel wants, your using patterns and you will and that cards feel the earning potential and you will advantages you could maximize and make your future journey not only you’ll be able to, but finest. Alternatively, unless you take advantage of these types of advantages several times a day, then you might need to you better think again opening otherwise carrying a benefits credit card with high yearly fee and benefits you don’t optimize. Following, find the credit cards that will secure added bonus items or miles when it comes to those categories to help you maximize every single dollar that you purchase. The new Chase Total Checking account now offers a top added bonus render after you establish head deposit, in addition to easy a method to waive the new fee every month. The brand new Pursue Complete Examining account features a monthly services commission away from a dozen (15, energetic August twenty four, 2025), nevertheless could possibly get qualify for a charge waiver.

They earns four kilometers for each buck for the eligible Western Air companies requests and you may step 1 loyalty click to read more section for each and every kilometer attained. The newest card has various advantages including a totally free seemed wallet, an excellent TSA PreCheck/International Entry borrowing from the bank all number of years and you can 25percent deals on the inflight purchases. The new Citi / AA Precious metal Find credit is an excellent choice for the occasional Western Air companies flyer.

Ink Company Premier

See to compare to three personal cards or three company cards at a time. 200 United traveling credit, yearly ten,000-kilometer prize trip dismiss, dos free searched handbags, and priority boarding. Secure 8x issues on the Pursue Take a trip purchases and 4x items to your routes and you may rooms reserved head. We used the Active Cash added bonus to repay several of my personal taxation, and you may I’m however securing to the Sapphire Preferred’s bonus for my personal next excursion. Extremely web based casinos render full mobile being compatible, therefore 3 hundredpercent added bonus gambling enterprise offers might be advertised and you will applied to mobile phones and you may pills. Very also offers lay the absolute minimum (age.grams., 10–20) and you may a limit (elizabeth.g., step 3,000).

Proceed with the Currency

The fresh card offers numerous eating report loans to assist offset the new down yearly percentage from 325. Discover their offer and see when you are eligible for as high as one hundred,one hundred thousand Registration Advantages points once using six,one hundred thousand for the orders within the first 6 months away from credit membership. The fresh Bluish Dollars Preferred Cards from American Share is just one of the better dollars-straight back playing cards available, particularly for anyone who spends a great deal for the supermarkets, online streaming functions, transportation, and you will fuel.

How to choose suitable Charge card Greeting Extra Offer

When the Amex Platinum ran their large-previously offer, candidates you will secure 100,000 extra points after spending 6,100 to your purchases inside first six months out of cards membership. Along with, they may secure 10 things for every buck to the « Store Quick » sales from the You.S. and also at eating global (to your around twenty-five,100 inside the joint requests) in the first six months from credit membership. Citibank is amongst the premier financial institutions from the You.S. and offers a checking account dollars extra. An excellent Citibank added bonus you’ll earn you 325, 750 or step 1,500 when you create an alternative Citi savings account and complete the necessary items. For those who save money with our cash return cards, you can get a much bigger acceptance incentive.

For individuals who’re concerned you to definitely opening a different family savings or closing a keen old you to definitely usually hurt your credit score, don’t be. Your bank accounts are not found in your credit score and you can, therefore, do not have influence on your credit score unless you provides a keen a good bad balance your bank converts over to a portfolio service. Because the Huntington Precious metal Advantages membership comes with a monthly twenty five fee, you might waive they by having twenty five,000 around the membership that have Huntington. By the updating to that particular membership, you’ll score increased bonus, rating unlimited payment-100 percent free Automatic teller machine distributions and you will earn 0.03percent focus on your harmony. To your Pursue Mobile software, you could potentially perform profile, pay the bills post currency to family having Zelle and you can put inspections of almost anyplace.

That it card is best for students who will meet the credit’s conditions of obtaining an excellent otherwise better borrowing and you will feel comfortable controlling their rewards framework. Fans of one’s Marriott brand who would like to secure free future stays is’t overcome the brand new cards’s most recent welcome offer. After you meet up with the minimal using specifications, you can start making plans for your next travel. The fivepercent added bonus categories might not line-up that have the place you invest every quarter (to your up to step 1,five-hundred inside using for each and every quarter that have activation). And you can beyond those individuals categories, the newest card produces simply step onepercent, that may easily be bested by most other perks notes. Visitors just who wear’t want to shell out top dollar for a credit card however, have to earn benefits to own future travelling reservations will see the capital You to definitely Venture Perks Mastercard as the ultimate fit.