Blogs

We set-aside the ability to render any membership holder that have a keen imaged item unlike the initial item. Target alter to possess put profile influenced by this document1. You are guilty of notifying you of any change in the target.

What to think about to possess contractor dumps:

Ensure that the property owner gets the target you would like the brand new put delivered to. The newest landlord should publish the money or even the report so you can your within this 21 days of the move-out time, if they have a message for your requirements. In case your building is actually condemned, plus it wasn’t the fault, the fresh landlord must go back the newest deposit inside five days.

Choosing the Harmony: Renal Problem and you may Large Phosphorus

Government legislation necessitates that your give us your Public Protection Number otherwise your boss Character Count just before starting people membership. While you are in the process of applying for for example an excellent count, we could possibly unlock your account briefly pending acknowledgment of one’s number. If you can’t provide us with the number, we could possibly intimate the fresh account any time instead past see to you personally. Insurance policies from a government Membership is unique in that the new insurance rates reaches the state custodian of the dumps that belong on the bodies otherwise societal unit, instead of for the bodies device alone. What number of couples, people, stockholders otherwise account signatories founded because of the a corporation, connection otherwise unincorporated organization doesn’t apply to insurance rates. Every piece of information within this brochure is dependant on the new FDIC laws and regulations and you will laws in effect from the publication.

How to Continue More $1 million Insured during the just one Financial

- If the covered institution goes wrong, FDIC insurance rates will cover the deposit accounts, and dominating and you will people accumulated interest, up to the insurance coverage restrict.

- The new FDIC establishes if or not these types of requirements are satisfied during the time of a covered bank’s failure.

- It means you should bet a specific amount before withdrawing one added bonus money.

- In the example of the fresh recent inability away from Silicon Area Bank, there is a race on the lender because the lots of corporate depositors got much, a lot more profit the account.

- For example financial institutions, retailers you to definitely take on cash costs away from $ten,100 or higher must statement your order while the bodies can be involved you to definitely such as cash costs are included in a bigger money laundering plan or associated with unlawful hobby.

- “Payable for the Passing” (POD) – You can even designate a single or shared account as payable abreast of your dying in order to a designated beneficiary otherwise beneficiaries.

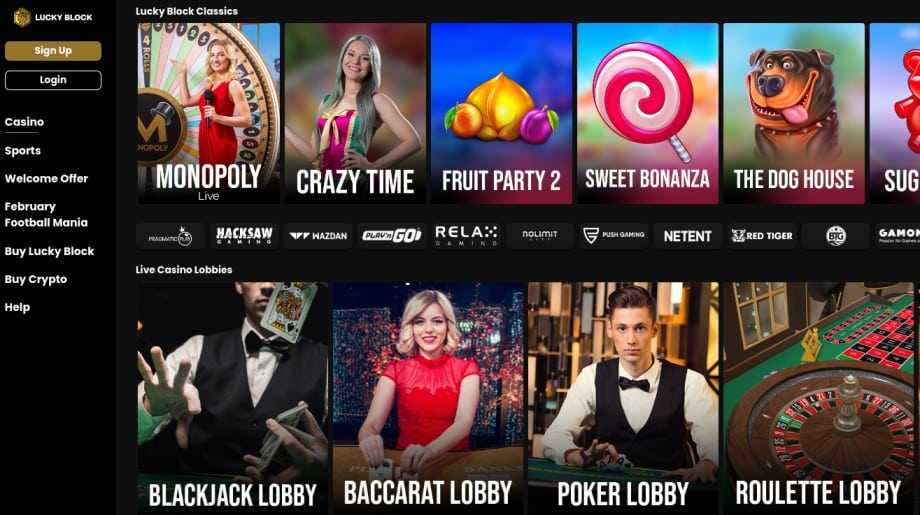

See internet sites that have finances-amicable choice limitations to help you take advantage of their deposit. All of our expert number has an informed authorized gambling enterprises where you could begin having fun https://crashneymar.net/app with merely $1—ideal for lowest-budget gaming having real cash benefits. The internet betting legislation inside the Canada will likely be hard to know for many. The fresh Canadian bodies has not outlawed on the internet betting such during the football web sites.

Past financial, the girl solutions covers credit and you may debt, student loans, paying, property, insurance coverage and small business. Qualified later years profile and you will faith account can have one or more beneficiaries. To join up from the DraftKings to explore the site and you may enjoy for just $5. You can deposit a lot more if you’d like, also, so that the acceptance extra provides much more incentive finance to own playing.

- A one-12 months Video game having a speeds away from 4% APY earns $500, because the exact same Computer game with a-1% APY earns $one hundred and one which have 0.10% APY earns $ten.

- The new FDIC makes sure dumps that a person keeps in one covered bank separately away from one deposits that people has an additional individually chartered covered lender.

- Certain condition-chartered borrowing unions offer more private insurance above the government limitation.

- A buyers membership is a free account stored from the an individual and you will used generally private, members of the family, or household aim.

Neglecting to Satisfy Betting Standards

You might not avoid fee for the a check which is used to purchase a good Cashier’s Take a look at, to your purchased Cashier’s View (but because the if you don’t available with relevant legislation), otherwise for the almost everything that has already eliminated or could have been paid off. Under certain issues, latest purchase information may not be readily available, as well as the goods where a stop fee might have been expected could possibly get already have been paid off. If your items where you may have averted commission has recently become paid off, we are going to reimburse the new end fee fee at the consult. All the stop fee purchases entered from you as a result of Teleservice24℠ end 6 months from the time inserted except if if you don’t renewed by the you in writing prior to they end. Whenever we accidently borrowing from the bank your bank account to have money that your commonly the fresh rightful owner, we may deduct that cash from the membership, even if this leads to your account becoming overdrawn.

For those who have a tendency to continue a lot of money on hand, it can be worth looking into an account that offers far more FDIC insurance versus $250,100000 limitation. If i was required to bet, I’d say we’ll ring in 2030 on the limit proper in which it is now. An ordinary-vanilla extract recession — and therefore we’lso are likely to come across one more of until the 10 years is out — won’t produce the kind of importance necessary for Congress to behave. And because banking companies spend to your federal put insurance rates system, Congress won’t enforce on them as opposed to justification. With so many banking institutions falling target in order to hackers, loan providers try stepping up its defense game plus specific cases, this means establishing constraints for the cash places. Cutting edge Bucks Deposit try a bank product that offers FDIC insurance policies (subject to applicable limits).

In case your discounts is nearer to $500 than $ten,one hundred thousand, you might consider a high-yield checking account or perks checking options, that may provides competitive interest levels which have limit harmony constraints. That is important because the brand new establishments managing these profile usually do not capture obligations to possess knowing if you curently have currency transferred with this banking institutions independent of the account they provide. Just in case (such as) you have a family savings which have a partner bank, then you may experience more than $250,000 placed in a single bank in the event the financial institution allocates area of your own put to that particular financial. The process functions by using the currency you place in the put membership and you can spread they round the a network away from financial institutions one is FDIC covered. « If you decide to deposit $dos million of cash in the Betterment, everything we should do is we may lay $250,100000 bullet robin to all or any of your own banking companies in the Betterment’s system, » states Mike Reust, President at the Improvement. « We make sure i’ve sufficient banking institutions to fulfill all of our guarantee for you, that is giving a certain FDIC insurance coverage restriction. Rather than your opening an account during the ten metropolitan areas, i fundamentally handle it for your requirements. »

If you’re not sure when the redemption period closes name their state sheriff. A landlord can keep your own deposit currency for rental for many who went out as opposed to providing proper composed observe. For many who get out instead of offering correct notice the property owner can be use the lease you didn’t spend in the put, even for date once you gone. A property manager will keep the put currency to own outstanding lease or almost every other fees that you decided to. The new property owner has to give you a full deposit having focus or a written declaration letting you know why he could be preserving your put, otherwise section of the put.

We are really not forced to spend a check demonstrated to own percentage over six months after its day (an excellent “Stale Look at”). Despite the new foregoing, you invest in keep you simple whenever we pay a Stale Take a look at. Unless you require me to shell out a great Stale Take a look at, you need to put a halt-fee order for the take a look at.

Placing which have Neteller concerns an excellent 2.99% commission, that have at least costs from $0.50. Regional time, otherwise such later on date published on the department, (9 p.m. ET to possess money deposited during the an automatic teller machine) for the any organization day would be paid to the appropriate account you to working day. Money transferred following over mentioned times might possibly be paid to your you to definitely working day or even the next working day. Delight consider the newest part of so it revelation named Deposit Accessibility Disclosure to decide when financing are offered for withdrawal and using deals on the account.

The internet form of that it pamphlet would be updated instantaneously in the event the rule change impacting FDIC insurance are built. Yes, you can buy put insurance over the latest visibility restriction, nonetheless it’s far less straightforward as calling the brand new FDIC and you will inquiring as well. Should your lender fails along with your account balance exceeds the present day FDIC insurance policies restriction, you could possibly get rid of the entire matter above the limitation.

You have the same examining and you may savings account, but you along with express a combined family savings along with your spouse having an excellent $five-hundred,100 harmony. Lower than FDIC insurance rates regulations, you and your partner perform for each and every have $250,100 inside visibility, therefore the whole membership was safe. However, $fifty,one hundred thousand of one’s cash in your unmarried control profile manage however end up being exposed. Stating a good $1 minimum deposit incentive in the casinos on the internet in the usa gives the bankroll a simple improve with little to no financial chance. You’ll be able to get also offers away from greatest online and sweepstakes casinos which have a small deposit. In contrast, You web based casinos will get wagering requirements attached to their incentives.